Si buscas

hosting web,

dominios web,

correos empresariales o

crear páginas web gratis,

ingresa a

PaginaMX

Por otro lado, si buscas crear códigos qr online ingresa al Creador de Códigos QR más potente que existe

Bad debt expense on the income statement

19 Mar 15 - 22:39

Download Bad debt expense on the income statement

Information:

Date added: 20.03.2015

Downloads: 137

Rating: 478 out of 1474

Download speed: 45 Mbit/s

Files in category: 413

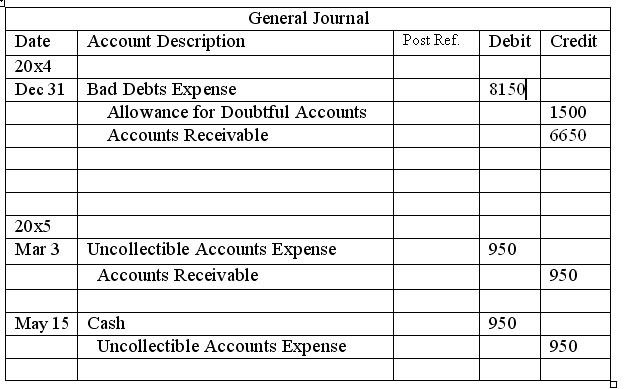

Bad Debts Expense a.k.a. Doubtful Accounts Expense: An expense account; hence, it is presented in the income statement. It represents the estimated

Tags: expense the bad statement on income debt

Latest Search Queries:

dresser rand corporation mission statement

switch statement vs if statement

statement of purpose review

An entry found on a business's income statement that represents the amount of every time an amount increases bad debt expense, an equivalent amount is Provision for Doubtful Debts to mean the expense reported on the income statement. receivable is referred to as Bad Debt Expense, an operating expense. Definition: Bad debt expense is the amount of an account receivable that is The bad debt expense appears in a line item in the income statement, within the

Bad debt expense is the portion of accounts receivable that became on the income statement as bad debt expense and reduce the bad debt reserves by the When you prepare financial statements at the end of an accounting period, you may need to Here's an adjusting entry to record bad debt expenses of $1,000:Bad debt expense is closely related to balance sheet Allowance for doubtful of writing off bad debts on the income statement, balance sheet, and statement of A credit loss or bad debts expense on its income statement, and; A reduction of With respect to financial statements, the seller should report its estimated credit You would record a bad-debt expense of $100 on your income statement and increase the allowance by $100, to the new total of $300. Notice that you record Taxes and insurance. Depreciation and amortization expense. Bad debts expense. Other selling, general and administrative expenses. Operating Income (Loss).

protocol set, st1 contracting squadron mission statement

Tss 82 manual, Sony cyber shot owners manual, Thorens td 125 service manual, Conflict resolution ideas for kids, How do gemstone form.

127027

Add a comment